Challenges to Tobacco Taxation: World No Tobacco Day

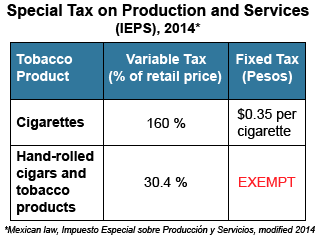

Tobacco control professionals in Mexico are fighting the decision to remove a fixed tax from hand-rolled cigars and cigarettes, five years after a tax increase that many celebrated as a public health success. Advocates are concerned that exemption of hand-rolled tobacco from this component of the tax policy could attract youth to the now-cheaper products, and may lead to the reversal of taxes on factory-manufactured tobacco products.

“The decision of the representatives and senators is a regression in terms of health, as it will increase the consumption of tobacco, as well as health risks,” said Erick Antonio Ochoa, Director of Tobacco Initiatives at the Fundación InterAmericana del Corazón México (FIC México). Injunctions to contest the law come from two organizations, FIC México and Cómunicación, Diálogo y Conciencia, S.C. (CODICE).

Concerns over Tax Exemption: A Setback to Progress

Following Congress’ approval (in 2009) to increase the tax on tobacco products, Mexico saw a nearly 30 percent decline in cigarette sales and a 38 percent increase in tobacco tax revenue from 2009 to 2011, despite the fall in sales.1 Excluding hand-rolled tobacco products from the law, which mandated 35 centavos of tax on every .75 grams of tobacco, means hand-rolled products would cost an average of 7 pesos less than factory-manufactured products.

In 2009, 10 percent of cigarettes and more than half of cigars in Mexico were hand-rolled.2 Health groups have already seen an increase in the availability of hand-rolled cigarettes and cigars in convenience stores, and are concerned that the tax exemption (and resulting lower prices) will make hand-rolled products even more accessible to youth, following trends that favor vintage styles and homemade products. “Overall, Mexicans have a clear awareness of the harm caused by cigarettes, but not cigars or hand-rolled products, which they believe are less harmful,” Ochoa says. According to a 2011 survey, 12 percent of Mexican adolescents are smokers, a 37 percent increase in prevalence from 2002.3

An Ongoing Battle

“Mexico needs to improve its tobacco control policies. The federal regulations do not meet all FCTC requirements,” Ochoa says. “Despite the demonstrated success of the [tax] policy, the Mexican government has not supported other tax adjustments for tobacco products.”

A decision from the court is hoped for by October 2014, though FIC México officials believe the injunction could continue to the Supreme Court if the decision favors the tax exemption for hand-rolled tobacco products.

Stay updated on the lawsuit’s progress via FIC México’s Facebook page and CODICE’s Facebook page.

Find all IGTC's World No Tobacco Day resources here.

1. México: Historia Acerca del Éxito del Impuesto al Tabaco, 2012, Campaign for Tobacco-free Kids

2. The Economics of Tobacco and Tobacco Taxation in Mexico, 2010, International Union Against Tuberculosis and Lung Disease

3. Encuesta Nacional de Adicciones 2011 Tobaco, 2011, Gobierno Federal Salud